Becoming a Day Trader without Capital Risk

Online proprietary trading firms like DreamTicks, which accept clients globally (excluding certain restricted countries), offer an opportunity to trade without risking your own capital. They require a modest registration fee, 100% refundable upon the first profit split.

Understanding Forex Day Trading

Forex day trading entails buying and selling currency pairs within a single day. This strategy can involve longer trades spanning hours or even the entire day, as well as short 1-minute trades. Day traders aim for consistent profits by analyzing the market and choosing entry and exit points when opportunities arise. Successful trades result in exiting the market, re-entering when another profitable opportunity emerges, and cutting losses short when trades go awry.

Earning Money with Forex Day Trading

Funded Forex trading firms like DreamTicks invest corporate capital in skilled traders, eliminating the need to risk personal capital. Through DreamTicks, traders can access funding of up to $200,000 by paying a nominal registration fee (starting from €99), which is fully refundable. Traders must successfully pass a two-step evaluation process to participate.

The income of a day trader in Forex depends on factors such as experience, decision-making skills, and the capital at risk. Profit levels vary widely, with one trader potentially earning $10,000 in a day, while another trading the same pair might make only $1,000. Ultimately, it comes down to effective risk management and the amount of capital employed.

Attributes of a Successful Trader

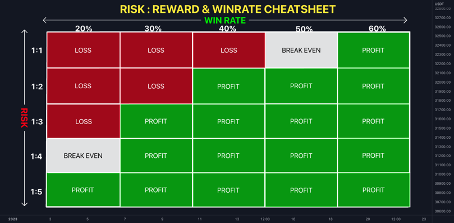

Win Rate: Day traders execute multiple trades daily, and the win rate represents the number of profitable trades relative to the total daily transactions. For instance, a trader with 6 profitable trades out of 10 has a 60% win rate. Winning more trades than losing is crucial for profitability, but the Risk to Reward (RRR) also plays a significant role. Even with a win rate below 50%, traders can be profitable if their RRR is favorable. A typical RRR is 1:3, meaning risking 50 pips to gain 150 pips.

Risk to Reward Ratio (RRR)

RRR measures the difference between the entry point, stop loss, and take profit levels. A higher RRR indicates a greater potential reward compared to the risk taken. Many traders use a 1:3 RRR, risking 50 pips to gain 150 pips. With this ratio, even a 34% win rate can lead to profitability.

Common Day Trading Strategies

Day traders employ various intraday strategies to profit from short-term price movements. Popular strategies include:

Range Trading: Identifying support and resistance levels within a price range and trading when prices reach these levels.

Scalping: Making small profits from quick price changes by opening and closing positions within minutes.

News-Based Trading: Trading based on market volatility around news events, aiming to profit from resulting price movements.

Getting Rich through Forex Trading

Assuming a starting capital of $100 and a maximum daily profit of 5%, you could make $5 per day or $100 per month. While this may seem appealing, it’s important to account for trading fees and commissions, which can reduce your net monthly gain. Achieving a consistent 100% monthly return, as mentioned earlier, is challenging.

For funded traders managing a $100,000 funded account, a 5% monthly return would translate to $5,000. Funded programs with initial fees as low as $99 can be an attractive option for those seeking substantial returns without risking their own capital.